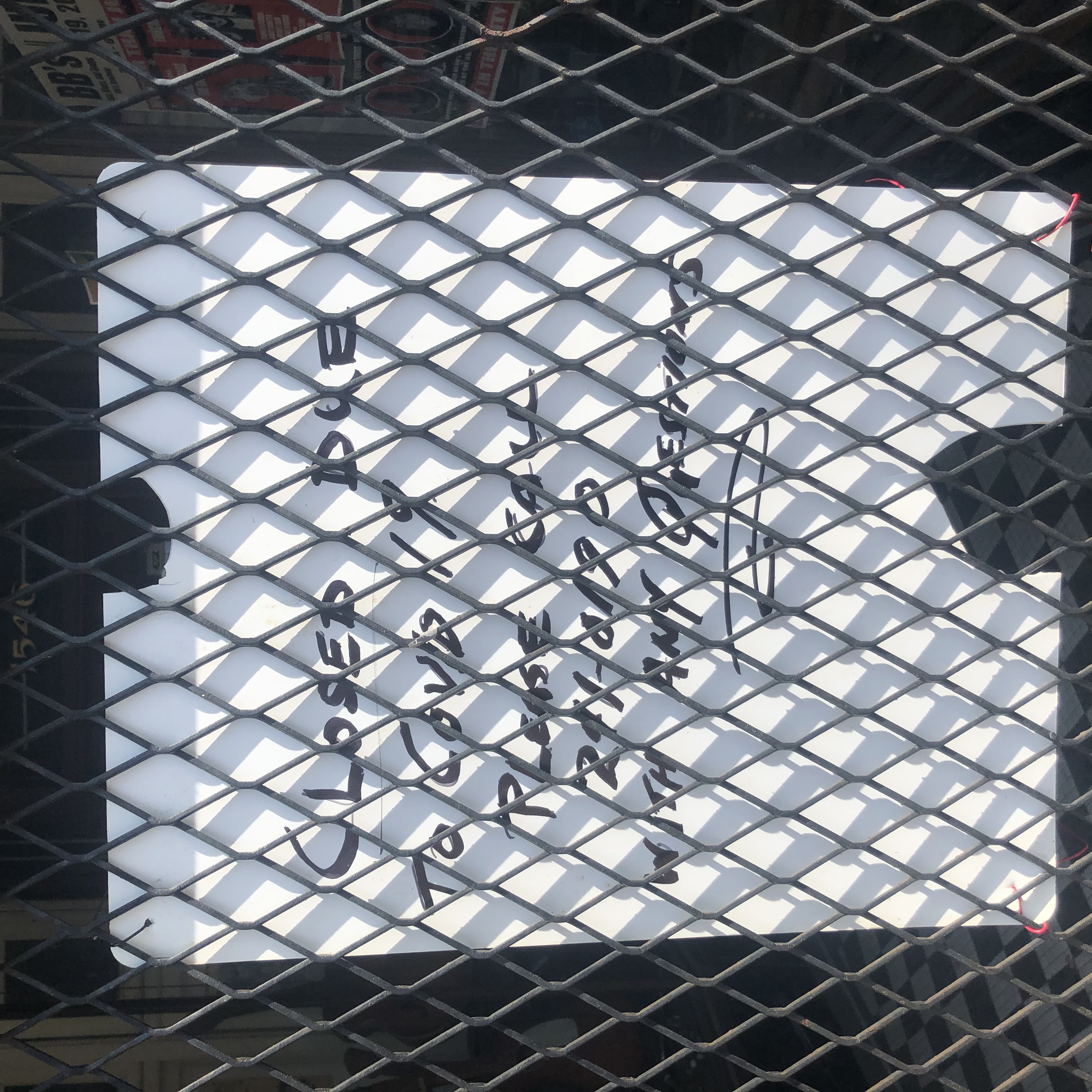

This is a quick guide to COVID-19 relief available to local, small businesses and workers.

“COVID-19 will bankrupt more people than it kills.” Variations of this rallying cry quickly emerged from groups opposed to the government’s shelter-in-place orders. Regardless of your stance on policies aimed at “flattening the curve,” no one disagrees that tough financial decisions weigh on businesses and their employees. To date, more than 22 million people in the United States filed for unemployment and that number continues to increase faster than government agencies and news reports can keep up with.

Blackrock Consulting realizes that St. Louis business owners, as well as their employees, feel unprepared to effectively react to this unprecedented challenge. The Coronavirus Air, Relief and Economic Security Act (“CARES Act”), along with complimentary federal, state, and local legislation contributes to the trillions of dollars infusing the economy. These efforts provide eligible small businesses access to essential resources and guide employees to financially navigate these turbulent times.

This post is intended to educate Missouri small businesses, self-employed workers, and employees – furloughed or laid off – about available resources. This is a general guideline, not legal advice. Always speak with an attorney and/or an accountant to determine what financial decisions are the best fit for your specific status.

Qualifications for paid leave during the COVID-19 crisis.

1. An employee is diagnosed with COVID-19 or is under a medical professional’s recommendation to enter quarantine. The Families First Coronavirus Response Act gives a full-time employee up to eighty (80) hours of paid sick leave at the employee’s regular wage/salary rate when that employee is unable to work (or unable to work from home) because a medical professional told the employee to self-isolate, and/or is experiencing COVID-19 symptoms while actively seeking medical attention. Part-time employees are eligible for paid leave based on the number of hours they normally work in a two-week period.

2. An employee is caring for a family member with COVID-19 or is quarantined themselves due to COVID-19. The Families First Coronavirus Response Act gives full-time employees who must leave work (and are unable to work from home) in order to care for a family member subjected to a COVID-19 quarantine, up to two-thirds (⅔) compensation of their normal wages for up to 80 hours. Part-time employees are eligible for a similar pay rate at the number of hours they normally work in a two-week window. The maximum daily pay is $200, and the total cap on paid leave is $2,000 per employee.

3. An employee’s child is no longer in school or daycare due to COVID-19 closures. The Families First Coronavirus Response Act gives full-time employees who must leave work (and are unable to work from home) to care for a child whose school or place of care is closed for reasons related to COVID-19 a maximum of 12 weeks of leave (2 weeks of paid sick leave followed by up to 10 weeks of paid expanded family & medical leave) for a period of up to 40 hours a week. A part-time employee is eligible for leave for the number of hours that the employee is normally scheduled to work over that period. Companies with fewer than fifty employees may be exempt if granting such leave jeopardizes the viability of the business. The maximum daily pay is $200 and the total cap on paid leave is $2,000 per employee.

4. An employer is forcing an employee to use earned paid time off during the COVID-19 crisis. Under the Fair Labor Standards Act, employers may leverage employees’ earned paid time off and require them to take the leave, as long as pay is provided during leave, as expected before COVID-19. An employer does not have to pay the employee for the first ten days of the emergency leave (employees may use paid time off during this period). After 10 days, employees are paid at two-thirds (⅔) of their regular rate of pay. Payments of emergency leave are capped at $200 per day and $10,000 per employee. No employer may retaliate against an employee for taking either the paid sick leave or emergency FMLA under Families First.

Unemployment benefits available to workers affected by COVID-19.

At the time of this publication, Missouri’s qualification standards for unemployment benefits have remained significantly unchanged. In short, to qualify for unemployment benefits, you must lose your job through no fault of your own or quit for good reasons related to the work or the employer. There is an extremely high standard to show that you’ve quit for good reason, and the standard is heavily fact dependent, so you should speak with an employment attorney before making that decision.

Generally, an employee who quits due to COVID-19 is not eligible for unemployment benefits. If an employer offers sick leave and/or other leave options to address COVID-19 in lieu of layoffs, a person who has quit of their own volition will likely not qualify for unemployment benefits. This is a continuously-changing area of law due to the impacts of COVID-19, so please speak with the Missouri Department of Labor, an attorney or an accountant about the best options for you. People who meet the following criteria may be eligible for unemployment benefits:

1. An employee is laid off or furloughed. There is a distinction between being laid off and being furloughed. Being laid off is a termination of the employer-employee relationship, while a furlough keeps the employer-employee relationship, but with a suspension of work and pay for a determined period of time. The U.S. Department of Labor’s Federal Pandemic Assistance Unemployment Compensation (FPUC) is a temporary program that is changing the benefits available to furloughed employees and unemployed workers. Both laid-off and furloughed employees may qualify for unemployment benefits during these times. In addition to traditional unemployment benefits, FPUC provides an additional $600/week for individuals who qualify for unemployment benefits. Payments are retroactive for claims filed on or after March 29, 2020.

2. An employee was not laid off, but hours were reduced to part-time status. An employee whose hours have been reduced may qualify for part-time unemployment benefits. The additional $600/week FPUC program discussed in the section above is also available.

3. An employee lives in Illinois, but works in Missouri. Generally speaking, for unemployment benefits, the state in which one works determines one’s unemployment benefits. Someone who lives in Illinois and commutes to work in Missouri, for example, will likely need to appeal to the Missouri Department of Labor.

Economic Relief available to small-business owners

and independent contractors affected by COVID-19.

1. An employer is a small business who cannot afford to keep staff on payroll, but does not want to lay them off or reduce hours. The Small Business Administration (SBA) and SBA-qualified banks are working to help small businesses weather COVID-19-related economic uncertainty. The SBA’s Economic Injury Disaster Loan (EIDL) and the Paycheck Protection Program (PPP) carry the primary benefits. Both provide low-interest loans that allow employers to mitigate lost revenues. Additionally, the PPP allows a forgivable loan, if 75% of the proceeds are used for payroll cost. The EIDL and PPP loans can be combined for maximum financial assistance, provided program requirements are adhered to. Even if you already laid off employees, you may still be eligible for the PPP loan, as long as you reinstate the payroll by June 30. If you are interested in applying for these loans, we recommend contacting an SBA-qualified bank. As of April 16, 2020, the $349 Billion dedicated to the PPP loan ran out of funds, but Congress is actively working to pass more funding for the program.

2. An employer is a small-business owner; can that owner collect unemployment if the company shuts down? Whether or not a small-business owner can collect unemployment benefits depends on the company’s legal structure. Interested owners should consult an accountant and/or an attorney before proceeding. Generally speaking, sole proprietorships do not contribute to unemployment benefits, outside of their employees; therefore, an owner is not eligible for unemployment benefits if the company shuts down. Employee-owners of limited liability companies may qualify for unemployment benefits if they pay themselves through a W2 form. Under the CARES Act, however, self-employed business owners may qualify for federal unemployment assistance (see below).

3. A worker does not qualify for traditional unemployment because that person is an exempt business owner, independent contractor (including gig-economy employees, such as rideshare workers, etc.), or a seasonal worker. Generally speaking, these individuals are exempt from unemployment benefits because they do not contribute to the unemployment insurance fund. However, due to the unique circumstances of COVID-19, the U.S. Department of Labor has implemented the Pandemic Unemployment Assistance (PUA) program. The PUA extends unemployment coverage benefits to self-employed individuals, freelancers, and independent contractors who otherwise do not qualify for unemployment. The Missouri Department of Labor issued a statement on April 6, 2020, that it is still refining the guidelines for PUA allocation in the state but will provide guidance as developed. https://labor.mo.gov/coronavirus for updates.

In the coming weeks, federal and local programs will change how workers and businesses face COVID-19’s harsh economic realities. For more information, reach out to Blackrock Consulting for general guidelines and resources. Contact us via our Facebook page (https://www.facebook.com/BlackrockConsultingLLC/).

We are here to help all Saint Louisans find a better tomorrow. Be safe, stay home, and take care of your loved ones.